We encourage all of our students to explore the resources and support services available to them at the School of Medicine.

Life in Richmond

We encourage our students to maintain a healthy work-life balance, and Richmond is a wonderful place to engage in a well-rounded lifestyle. As a mid-sized city with a metropolitan population of 1.3 million, Richmond features vibrant neighborhoods that offer distinct, diverse experiences, with no shortage of art galleries, museums, music venues, restaurants, breweries and parks.

School of Medicine Resources

Virginia Commonwealth University Resources

Student-led Initiatives

In the News

M2 reflects on 'utterly fascinating' early exposure to neurosurgery

Tue, Oct 17, '23

Medical student orientation session sheds light on systemic health inequities

Mon, Sep 11, '23

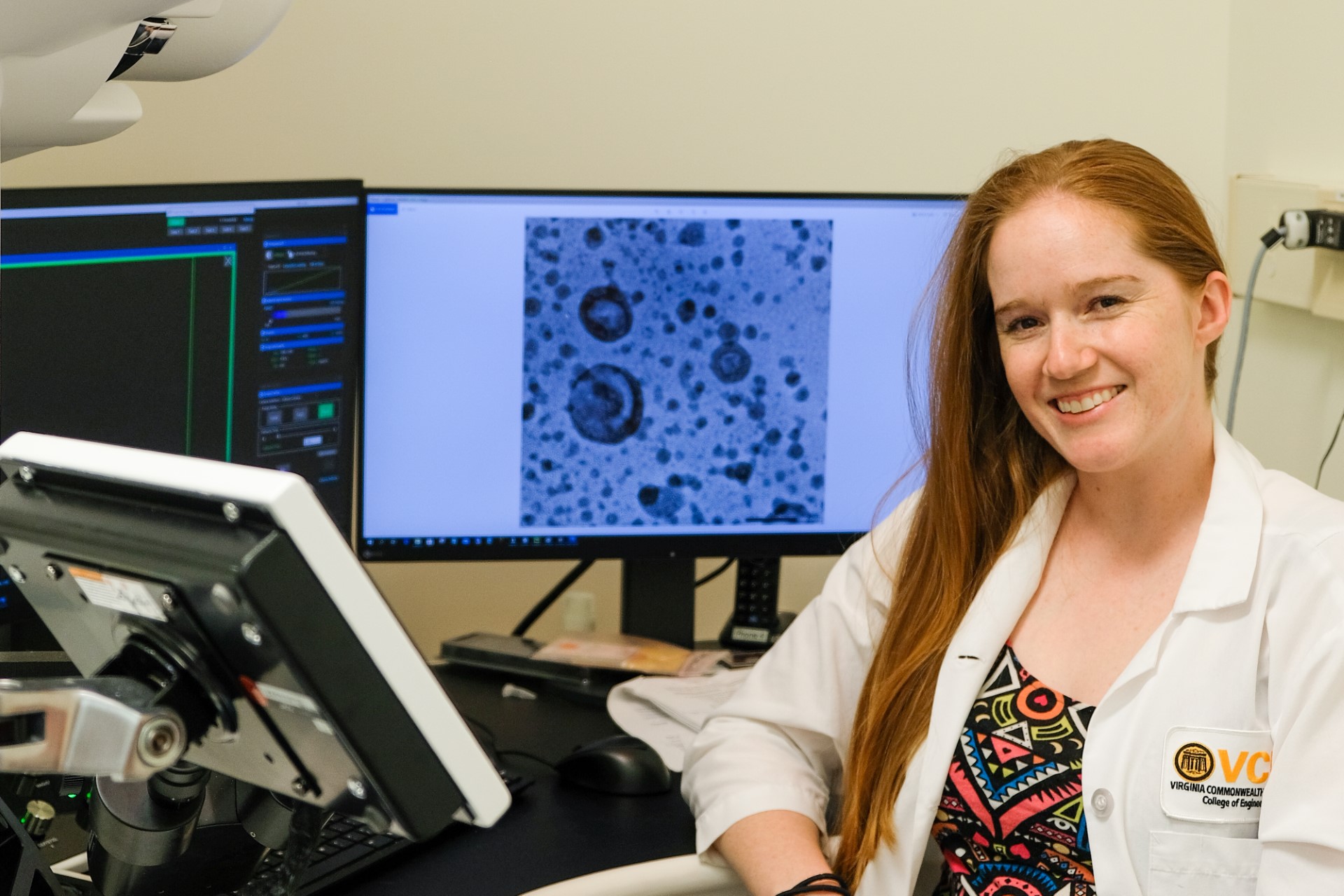

Aspiring medical scientist Anne Skelton wants to use her research to become a better surgeon

Tue, Sep 5, '23

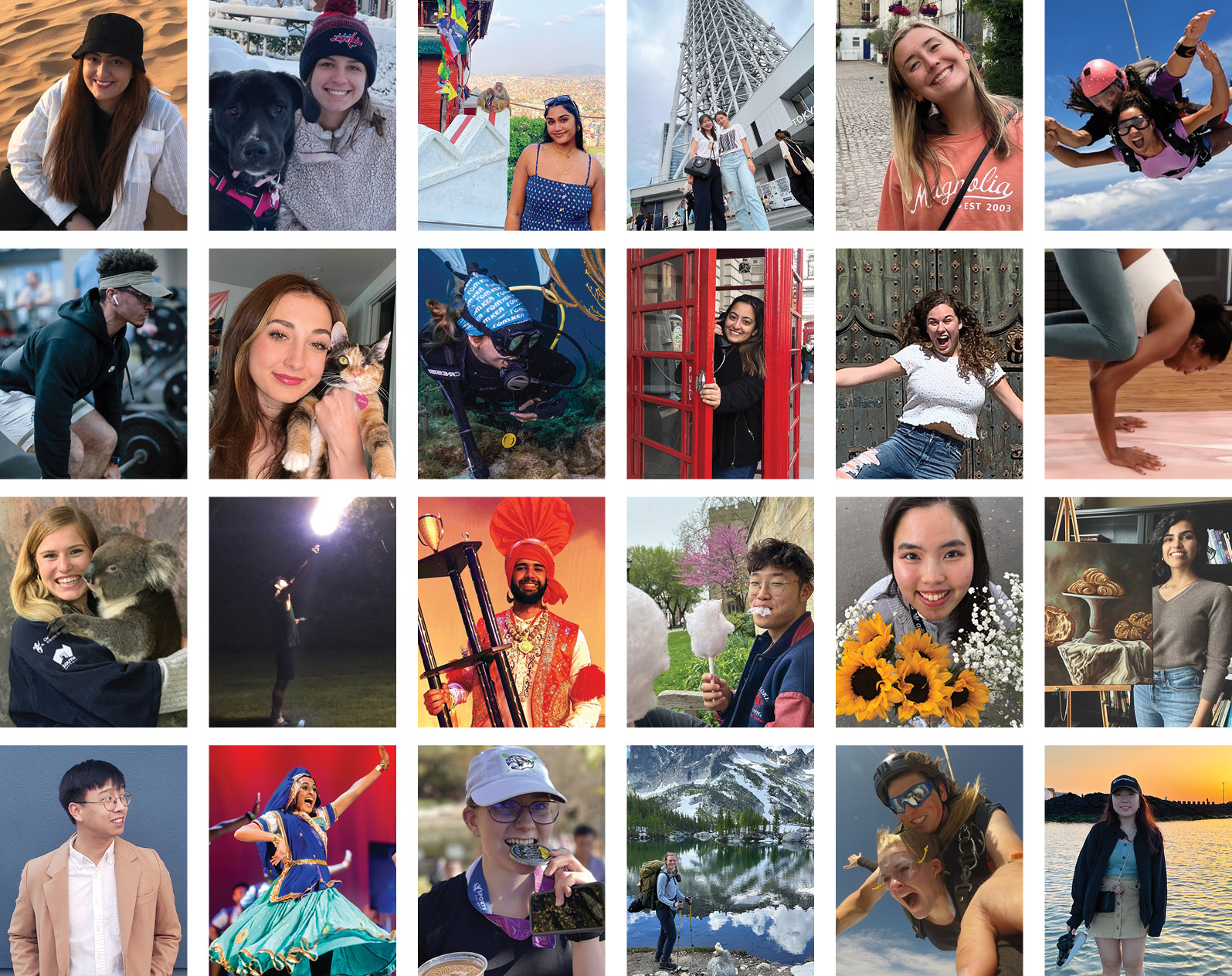

Welcome Class of 2027

Tue, Jul 25, '23

Wellness session highlights self-care techniques for new doctors

Wed, Jul 5, '23

A budding scientist goes to Washington

Mon, Jul 3, '23

Practicing compassion

Wed, May 24, '23

Match Day 2023: A momentous occasion

Tue, Mar 21, '23